Commercial Customs Data

Identify the data and documentation required when sending on our globalexpress and irelandexpress services.

A customs declaration is required for all exports of parcels from the UK to overseas destinations (and imports of parcels to the UK from overseas). The customs declaration is managed and submitted by Parcelforce Worldwide (and our chosen partners) as appropriate for each product. Customs agencies use the information provided within the customs declaration to ensure items are compliant with their own local regulations and to calculate what, if any, tax and duties are due. If you are sending goods to a country outside of the UK, you must provide full and accurate information to avoid parcels being rejected by customs. For more information please visit gov.uk's website.

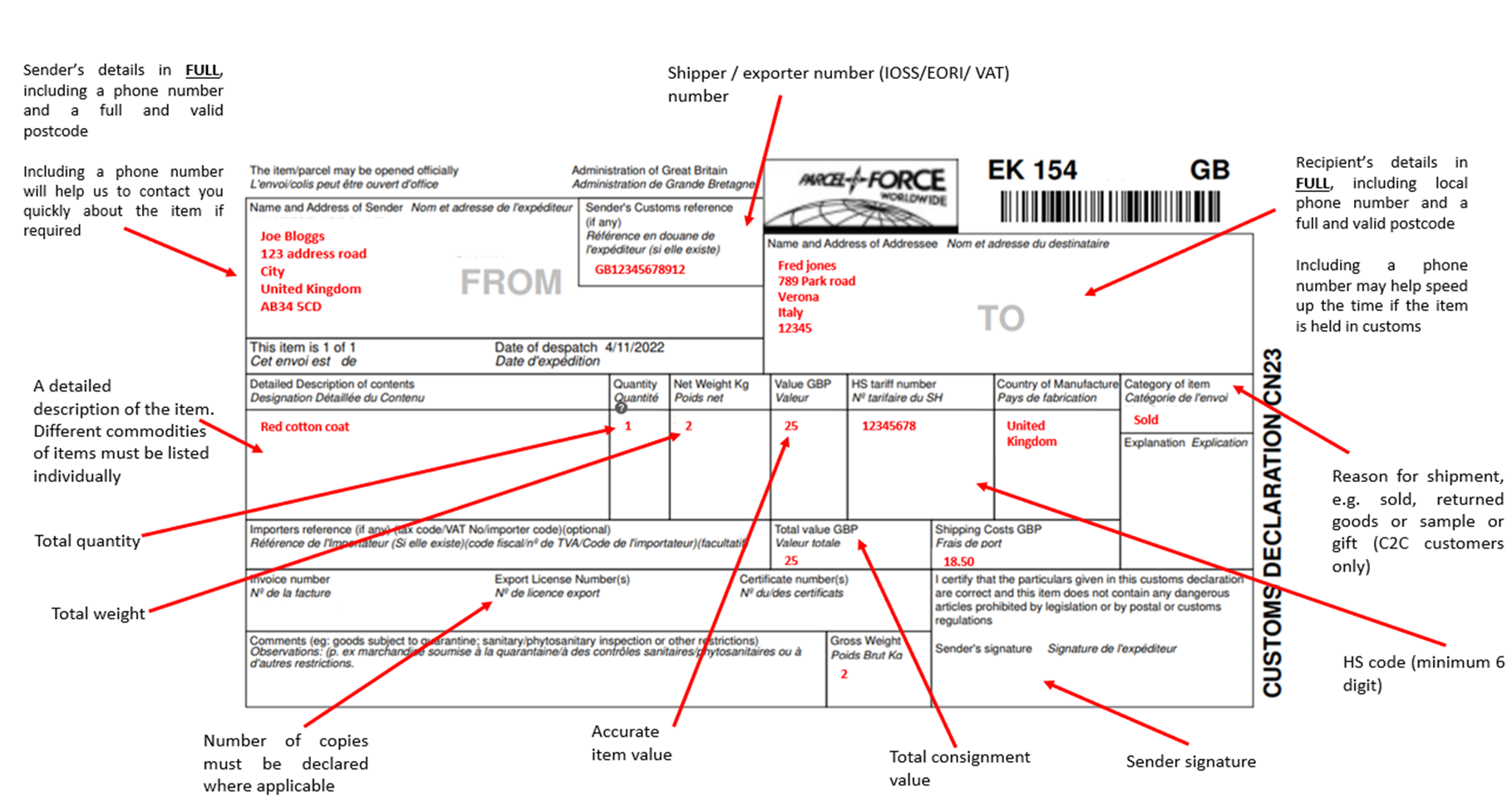

The CN23 is officially recognised document to capture essential details to support and make the customs declarations in the UK and in destination countries.

Each destination is responsible for setting their own import controls on restricted goods. Customers are advised to identify whether items being imported into a specific destination will require licences / certificates or incur additional charges. To identify specific Country requirements, please visit our individual country pages.

*Please note: When sending items from Northern Ireland to the EU, no customs declarations are required for sending gifts or goods.

A commercial invoice is a supporting document for customs purposes. The commercial invoice enables the overseas customs authorities to confirm required information about the goods you are sending.

These documents must be physically provided when sending the item. We recommend you include these physical documents within a plastic wallet affixed to the outside of the parcel. You must attach this to the same side as your address label where size permits, however if this not possible, we suggest that you attach it on the reverse/back of the item if there is sufficient space. Items sent without valid or incorrectly or partially completed documents may be delayed or returned to sender. These documents will need to be completed accurately and in full.

You must ensure that you are confident that the information provided is true and accurate reflection of the items being dispatched. PFW cannot be held liable for any incorrect information but the sender can be legally responsible for ensuring data provided for customs purposes is accurate. It is worthwhile ensuring that you are familiar with the customs laws for exporting and importing.

Electronic customs data is also mandatory. Any items with incomplete or missing data may be delayed or returned.

| Products | Data Needed | Documents |

|---|---|---|

|

globalexpress |

Sender’s details in FULL, including phone numberIt is mandatory to include the senders full name, address and postcode, alongside phone number. Recipient’s details in FULL, including phone numberIt is mandatory to include the recipients full name, address and postcode, alongside phone number. This must be a local phone number and not a UK number. Sender’s GB EORI number (if applicable)Shipper EORI numbers should start with 'GB', followed by 12 digits (14 characters in total). Where this is provided incorrectly, the package is likely to be returned or delayed. Reason for ShipmentFor example gift, sold, returned goods or sample Content DescriptionThis must be as detailed as possible e.g. Women’s cotton t-shirt / Children’s board game / Cadbury’s Milk Chocolate Bar Gift’ is not an applicable description for commercial items (C2C). Customs use the item description to facilitate border checks. The HS/Tariff Code (minimum 8 digits)Tariff Codes are an internationally recognised standard which means your product items can easily be identified worldwide by all customs systems, regardless of language barriers. This makes it easier for overseas partners to process the item through customs. To find out more please click here. (Please note that, PFW cannot be held liable for the HS code selection). Item value for each individual item in the parcelPlease DO NOT combine the value of the parcel, if the content is not the same. If you have a mixture of goods within the parcel, these MUST be entered separately. The item value is the customs value of the goods and should not include postage. Item can never be declared as zero value regardless of why the item is being sent - this includes gifts, samples, returns/repairs etc. See HERE on how to value goods for customs purposes. Individual item weight for each item in the parcelAccurate weights are required for each item in the parcel to ensure that the customs duty and taxes can be calculated where applicable to weight-based calculations. Country of OriginThis means the country where the goods originated e.g. were last significantly manufactured or assembled. There are specific rules around what constitutes as ‘originating status’ HERE. Sender’s SignatureBy signing you confirm that the data provided is true and accurate for customs purposes and you remain responsible for the accuracy of the data. |

Product label |

|

irelandexpress |

Sender’s Details in FULL, including Phone NumberInclude the senders full name, address and postcode, alongside a phone number. This will ensure you can be contacted regarding the item if required. Recipient’s Details in FULL, including Phone NumberThis is required by overseas customs authorities and will help the recipient to be contacted if required. There is an increased risk of customs delay if this information is not been provided. Please ensure that you provide local contact details. Reason for ShipmentThis is a mandatory field for customs purposes Content DescriptionThis must be as detailed as possible e.g. Women’s cotton t-shirt / Children’s board game / Cadbury’s Milk Chocolate Bar Not: Clothing / Toy / Sweets Gift’ is not an applicable description for commercial items (C2C). Customs use the content description to facilitate border checks. The HS/Tariff Code (8 digits)Tariff Codes are an internationally recognised standard which means your product items can easily be identified worldwide by all customs systems, regardless of language barriers. This makes it easier for overseas partners to process the item through customs. To find out more please click here. (Please note that, PFW cannot be held liable for the HS code selection). Item value for each individual item in the parcelPlease DO NOT combine the value of the parcel, if the content is not the same. If you have a mixture of goods within the parcel, these MUST be entered separately. The item value is the customs value of the goods and should not include postage. Item can never be declared as zero value regardless of why the item is being sent - this includes gifts, samples, returns/repairs etc. See HERE on how to value goods for customs purposes. Individual item weight for each item in the parcelAccurate weights are required for each item in the parcel to ensure that the customs duty and taxes can be calculated where applicable to weight-based calculations. Country of OriginThis means the country where the goods originated e.g. were last significantly manufactured or assembled. There are specific rules around what constitutes as ‘originating status’ HERE. Sender’s SignatureBy signing you confirm that the data provided is true and accurate for customs purposes and you remain responsible for the accuracy of the data. |

Product label Note: Documentation is not produced for customs purposes |

To identify specific Country requirements, please visit our individual country pages here.

Certain goods being exported to some countries may require an export licence or a document from other regulatory bodies. Attach it to the package in a clearly marked envelope. Customers must also advise us of this electronically as part of the booking process.

Please check with the relevant government department prior to shipping your goods to see if they require additional licenses or documents.

For items being sent to countries outside of the UK the customs thresholds at which point taxes and duties are applicable will vary from country to country and are decided by local customs authorities. We would always recommend that you check these before sending and further information on this can be found here.

For customers sending an item from NI to the EU there is no requirement to complete and apply a customs declaration. NI remains in the EU Customs Union and therefore customs taxes and duties are not applicable. The taxes and duties applied depend on the individual contents of the parcel, the weight, and the value.

Yes, if you are shipping item/s to the Channel Islands you will require custom declarations. This includes Jersey, Guernsey, Alderney, Herm and Sark. Please note goods to Jersey may also be liable for GST (Goods and Service Tax) which is currently 5%. Find out more about shipping to the Channel Islands at our Worldwide Directory.